Denied Claims in Medical Billing

BLOG OUTLINE

What are DENIED CLAIMS IN MEDICAL BILLING

Denied claims in medical billing are one of the most common challenges faced by healthcare providers. Essentially, a claim is denied when an insurance company refuses to reimburse for services rendered by healthcare providers. The refusal can either be due to error in claim submission or the service provided by healthcare provider does not meet the insurance coverage guidelines. For example, a simple coding mistake or an insurance coverage issue can lead to a claim being denied, causing reimbursement delays and disruptions in a healthcare practice’s cash flow.

Think of it this way: When an insurance company denies a claim, the payment of a medical practice is put on hold. Such administrative burden apart from core medical activities can be frustrating for healthcare providers, especially when they know that the service was necessary and should be covered under insurance policy. Understanding the reasons behind denials and knowing how to manage them is crucial for ensuring timely reimbursements and maintaining the financial health of your practice.

Claim Adjustment Group Code (CAGC)

One of the first things to encounter when an insurance company denies claims in medical billing is the Claim Adjustment Group Code (CAGC). These codes are issued by insurance companies to explain the reason behind a claim denial or adjustment.

For example, an insurance company denies a claim because of an invalid procedure code. The corresponding CAGC might be “CO-16,” which means the procedure is not covered under the patient’s plan. By understanding and referencing these codes, billing specialists can identify the issue more easily and devise a claim resolution strategy faster.

By tracking these codes, healthcare providers or their medical billing company can identify patterns and proactively address recurring issues to reduce the number of denied claims in future.

Remittance Advice Remark Code (RARC)

When an insurer denies a claim, they often include a Remittance Advice Remark Code (RARC) that provides additional information about the claim denial. These codes can help clarify exactly why a claim was denied and can vary from “Missing Information” to “Medical Necessity Not Established.”

Example: If a claim is submitted for a surgery but forgot to include the modifier to specify the side of the body the procedure was performed on, the RARC might say something like “M61,” indicating that additional documentation is required to process the claim.

Knowing how to interpret these codes can help you quickly determine what needs to be fixed, speeding up the appeals process and reducing the risk of claim denials in future.

Common Reasons for Denied Claims IN MEDICAL BILLING

Understanding why insurance companies deny claims in medical billing is key to preventing future mistakes. Here are some of the most common reasons for claim denials:

Coding Errors

By recognizing these common reasons, you can take preventive actions to reduce the risk of denied claims in medical billing.

Denied claims in medical billing can significantly impact healthcare providers both financially and operationally. Here’s how:

Denied claims delay payment, which directly affects your cash flow. For example, if 20% of your claims are denied and you fail to resubmit them promptly, it can create a backlog, affecting the overall revenue cycle.

Each denied claim requires attention—either to fix coding errors, clarify documentation, or appeal the decision. This diverts staff from other important tasks, which can lead to inefficiencies.

Denied claims can also affect patient satisfaction, especially if they’re left with out-of-pocket expenses they weren’t expecting.

To avoid these impacts, it’s essential to actively manage denied claims and resolve them as quickly as possible.

Strategies to prevent Denied Claims in medical billing

Reducing the frequency of denied claims in medical billing requires a proactive approach. Here are some strategies to help you minimize denials:

- Verify Insurance Eligibility: Always check the patient’s insurance coverage before services are rendered to ensure patient is eligible and to avoid “no coverage” denials.

- Use Correct and Updated Codes: Ensure that the medical codes application is accurate and updated. An outdated or incorrect medical code can result in a claim denial.

- Ensure Timely Submission: File claims promptly to avoid “timely filing” denials. Aim to submit claims within the first 24-48 hours after the service is provided.

- Obtain Pre-Authorization: For services that require pre-authorization, always get approval before performing the procedure. This prevents denials for “lack of pre-authorization.”

- Ongoing Staff Training: Make sure your medical billing team is well-trained on the latest medical coding systems and insurance regulations to avoid costly mistakes.

HOW TO SUBMIT APPEAL for Denied Claims IN MEDICAL BILLING

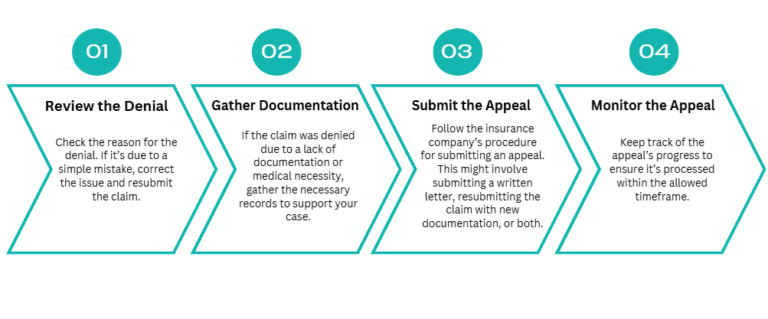

When an insurance company denies claims in medical billing, the appeals process allows you to challenge the decision. Here’s a step-by-step guide:

An effective appeals process can result in the reversal of an unjust denial, ensuring that you get paid for the services you’ve provided.

Importance of Accurate Documentation in Medical Billing

Accurate documentation is the foundation of preventing denials in medical billing. Without proper documentation, even the most straightforward claims can be denied.

For example, let’s say you performed knee surgery and submitted a claim without including details about the medical necessity of the procedure. The insurer could deny the claim due to “lack of medical documentation.” To avoid this, ensure that every service is thoroughly documented and supports the claim.

Think of documentation as your proof that a service was medically necessary and appropriate. The more detailed and accurate your documentation, the less likely you are to face denials.

EFFECTIVE USE OF Technology TO REDUCE Claim DENIALS

Modern technology can significantly reduce the frequency of claim denials in medical billing. Consider the following tools:

By investing in technology, you can streamline the claims process, reduce errors, and ultimately reduce the risk of denied claims in medical billing.

Training and Education for Medical Billing Staff

Continuous training is vital for keeping your medical billing team up to date on the latest insurance policies, medical codes, and industry regulations. Educated billing staff are less likely to make mistakes that could result in claims being denied.

Consider offering regular workshops or online courses on topics such as:

- New coding systems

- Insurance payer policies

- Denial management best practices

This will help your staff stay on top of the complexities of medical billing and ensure that claims are processed correctly the first time.

Outsourcing BILLING OPERATIONS: A SOLUTION TO MANAGE Denied Claims IN MEDICAL BILLING

Outsourcing your medical billing can be a smart way to manage denied claims. A third-party billing service can handle the complexities of insurance follow-up, resubmissions, and appeals. An outsourced medical billing company plays a crucial role in assisting healthcare providers with denied claims by leveraging specialized expertise, advanced technology, and dedicated resources. These companies begin by conducting a thorough denial analysis to identify patterns and root causes of claim rejections. By categorizing denials—whether due to coding errors, missing information, or eligibility issues—they develop strategies to minimize future occurrences. Their expertise in claim scrubbing ensures that errors are detected and corrected before submission, reducing the risk of denials.

- Identify the Denial Reason - Review the denial notice to understand why the claim was denied.

- Gather Documentation - Collect any necessary documentation, such as patient records or medical necessity statements.

- Submit the Appeal - Correct the errors and resubmit the claim to the insurer. Be sure to meet all deadlines for the appeal process.

- Track the Appeal - Stay on top of your appeal’s status to ensure it is processed in a timely manner.

Promptly addressing the denied claims will help minimize disruptions to your practice’s revenue cycle.

MEDSTATES: THE PERFECT CHOICE TO address denied claims in MEDICAL BILLING OPERATIONS of your practice

Outsourcing medical billing to the right company can make a significant difference in revenue cycle management, claim approvals, and overall financial stability for healthcare providers. At MedStates, we specialize in denial management, ensuring that your practice experiences minimal disruptions due to claim denials. Our team of highly skilled billing and coding experts works proactively to identify the root causes of denied claims, swiftly correct errors, and resubmit claims with accuracy. We understand the complexities of payer policies and ensure that all claims comply with the latest regulations, reducing the chances of future denials. With our expertise, healthcare providers can focus on patient care while we handle the financial and administrative complexities.

One of the biggest advantages of choosing MedStates is our commitment to maximizing reimbursements while minimizing denied claims in medical billing. Unlike generic billing services, we tailor our approach to fit the unique needs of each healthcare provider, offering customized solutions to optimize billing efficiency. Our real-time claim tracking, AI-driven claim scrubbing, and data analytics allow us to detect potential issues before claims are submitted, ensuring a smoother billing process and a faster revenue cycle.

Cost efficiency is another key reason to partner with MedStates. Maintaining an in-house billing department can be expensive, requiring investments in staff training, software, and compliance updates. By outsourcing to MedStates, healthcare providers eliminate these overhead costs while gaining access to cutting-edge billing technology and experienced professionals who handle claims with precision. Our team is well-versed in payer negotiations, helping providers receive their rightful reimbursements without unnecessary delays.

We also prioritize transparent communication and persistent follow-ups with insurance companies, ensuring that denied claims in medical billing are efficiently appealed and resolved. Our proactive denial management strategy prevents revenue loss and maintains financial stability for our clients. Additionally, our commitment to compliance ensures that providers stay ahead of ever-changing billing regulations, reducing legal and financial risks.

At MedStates, we don’t just process claims—we partner with healthcare providers to improve their financial outcomes. Our personalized approach, advanced technology, and deep expertise in medical billing make us the ideal choice for handling claim denials efficiently. By choosing MedStates, healthcare providers gain a trusted ally that ensures a seamless billing process, maximized reimbursements, and reduced administrative burden. Let us take care of your claims so you can focus on what matters most—delivering quality patient care.